|

We've updated our CSCF Simulator based on the ETS trilogue agreement of December 2022, finding that the risk of a CSCF in Phase IV remains low.

The simulator works as described in our earlier post of 15/07/21 but has been adjusted to match the cap provisions in the final trilogue agreement. You can adjust the HAL (Historical Activity Level) parameter to test different scenarios. Please note that the simulator does not consider the following:

The simulator assumes that changes in allocation due to the CBAM Factor, Article 10a(1), and dynamic adjustments will be administered so as not to affect the general CSCF value. For further information, or to provide feedback, please contact [email protected]

0 Comments

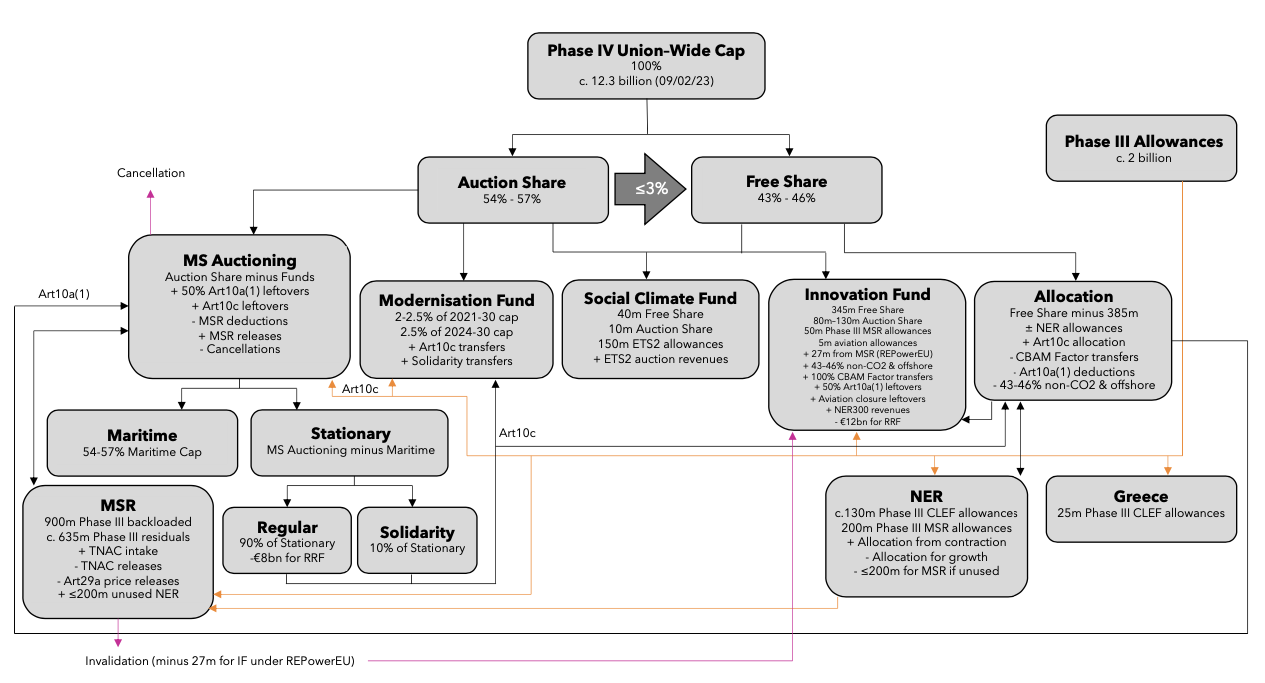

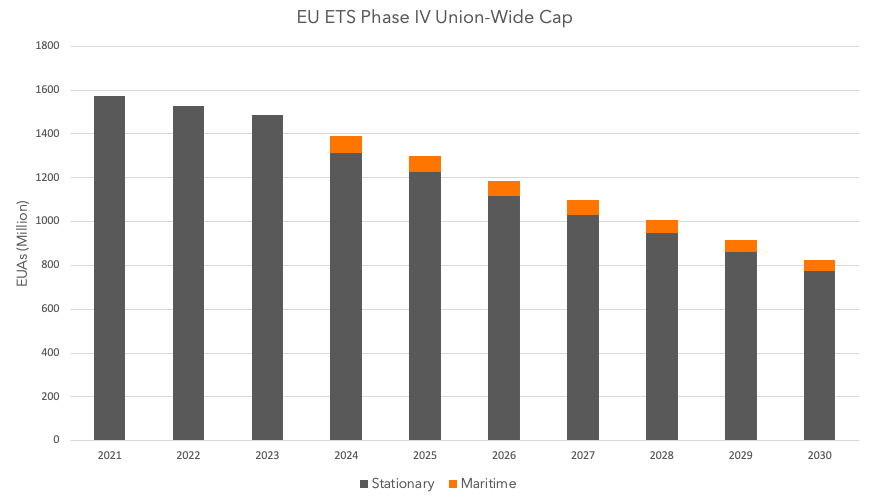

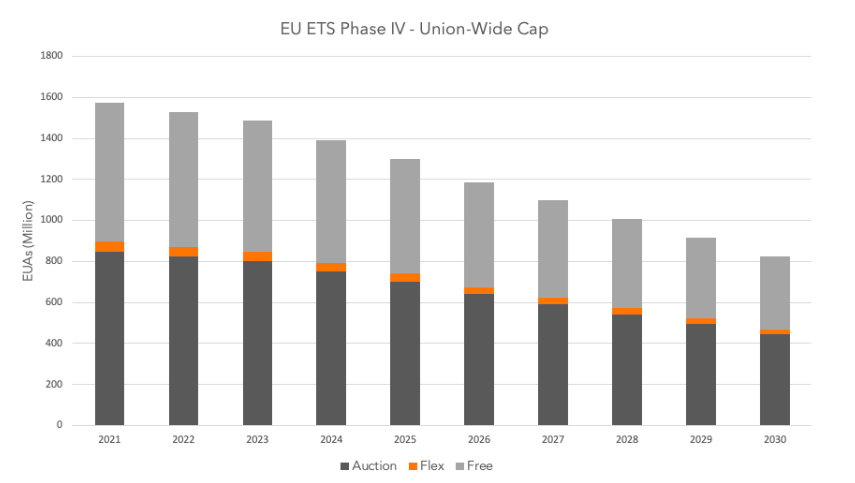

Here's our overview of the new EU ETS Phase IV Union-Wide cap based on our analysis of the trilogue agreement (and REPowerEU agreement) of December 2022. Precise cap figures have yet to be announced.

For further information, or to provide feedback, please contact [email protected]

Our CSCF Simulator suggests that the Commission's ETS Fit-for-55 reform proposal is more resilient to a CSCF than the Impact Assessment might suggest.

The difference in finding seems to be due to the following factors:

Assuming the Commission's rule changes are introduced in 2024, and activity levels and emissions intensity improvements are consistent in the baseline periods, the proposal just avoids a CSCF. See below for an explanation of the model and its assumptions in more detail. The parameters can be adjusted directly below. For further information, or to provide feedback, contact [email protected] EXPLANATION

DATA SOURCES Benchmark data report Phase IV cap and LRF value Phase III cap and LRF value Commission's ETS reform proposal

Updated on 29/07/21 and 13/05/22

Try our MSR Simulator to estimate how many allowances will be invalidated during Phase IV under the Commission's Fit-for-55 ETS proposals. See below for an explanation of the model and its assumptions in more detail. The parameters can be adjusted directly below. For further information, or to provide feedback, contact [email protected]

OVERVIEW

METHODOLOGY

TNAC SUPPLY

TNAC DEMAND

CONSIDERATIONS When adjusting the parameters, it may be useful to bear in mind the following:

DATA SOURCES Commission’s ETS reform proposal Commission’s Aviation ETS proposal Commission’s MSR proposal In this post we look at a simple EU Carbon Border Adjustment (CBA) design that would tax imports, before exploring some options for dealing with exports.

Import CBA design Principles 1. Maintain the Phase IV free allocation methodology, where an installation in a sector on the Carbon Leakage List (that is not a new entrant and that makes a benchmarked product) is awarded allowances based on the following calculation: Allocation = CLEF x PB x PT x CSCF CLEF – Carbon Leakage Exposure Factor (currently 1 for sectors on the Carbon Leakage List) PB – Product Benchmark used in the EU ETS for the product in question (CO2e/t) PT – Product Tonnage (adjusted over time in Phase IV to take account of production changes) CSCF – Cross Sectoral Correction Factor applied to entitlements that year (due to there not being sufficient allowances) 2. Levy a carbon tax on imports of the same energy-intensive products that have product benchmarks in the EU ETS 3. Use the EU ETS carbon price as the rate of the tax, taking the average price over a suitable time period 4. Charge the tax on an amount of emissions per tonne of imported product that is equivalent to the amount of emissions, on average, not covered by free allocation within the EU for a tonne of that product: Chargeable Emissions = IT x [AEI – (CLEF x PB x CSCF)] IT – Import Tonnage AEI – Average Emissions Intensity for the product in question in the EU (CO2e/t) CLEF – Carbon Leakage Exposure Factor (currently 1 for sectors on the Carbon Leakage List) PB – Product Benchmark used in the EU ETS for the product in question (CO2e/t) CSCF – Cross Sectoral Correction Factor applied to entitlements that year (due to there not being sufficient allowances) 5. Allow foreign producers to provide evidence that their emissions intensity is better than AEI, and/or that they are already subject to a carbon price in their jurisdiction for the emissions, so that their obligation can be reduced accordingly Advantages

Issues

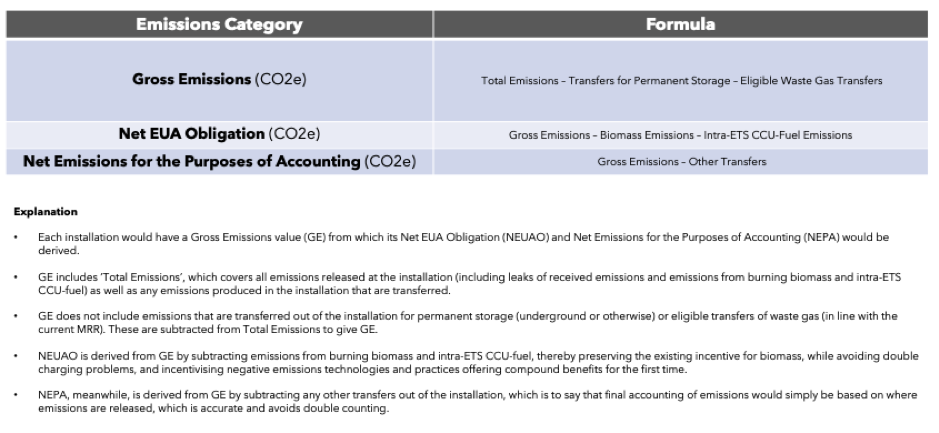

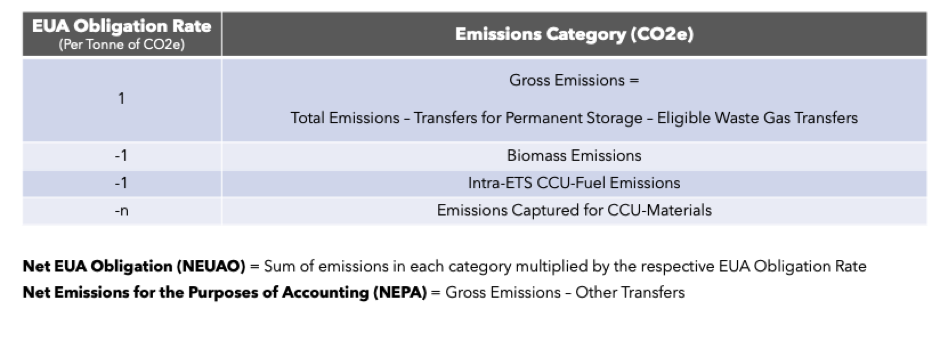

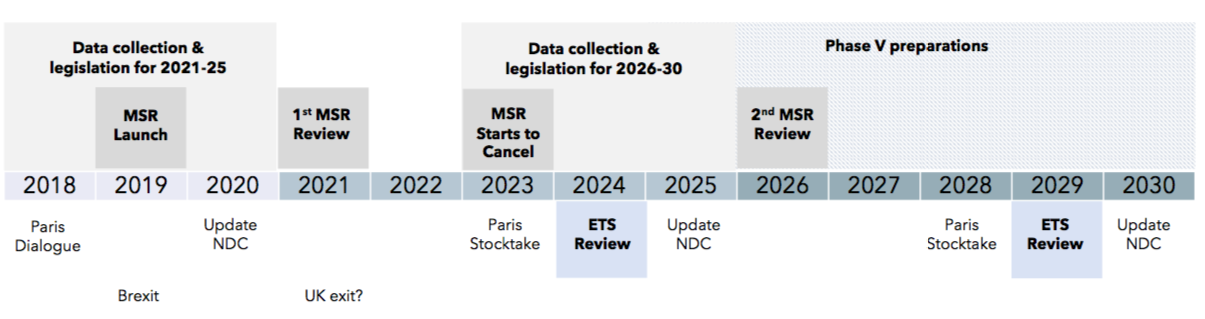

Export options Reimbursement One option to protect the competitiveness of exporters is to reimburse them up to benchmark level for emissions per tonne of exported product not covered by free allocation (again building in consideration of the CLEF and CSCF, so as to adjust automatically to any reduction in free allocation over time). That is, Reimbursable Emissions = ET x [PB – (CLEF x PB x CSCF)] ET – Export Tonnage PB – Product Benchmark used in the EU ETS for the product in question (CO2e/t) CLEF – Carbon Leakage Exposure Factor (currently 1 for sectors on the Carbon Leakage List) CSCF – Cross Sectoral Correction Factor applied to entitlements that year (due to there not being sufficient allowances) And emissions would be reimbursed at the rate of the EU ETS carbon price (averaged over a suitable time period). Notwithstanding the fact that the carbon price used in the reimbursement may differ from the actual price paid for EUAs surrendered in relation to the production of the products, we can note that the net situation after surrender and reimbursement would be that an exporter pays (or receives) a percentage of the carbon price on every tonne exported, depending on their emissions intensity (where an installation meeting benchmark pays/receives 0%). This would expose exporters fully to the carbon price signal with respect to emissions intensity performance while reducing their carbon costs. It would also abate (or even reverse) the carbon price signal with respect to production decisions, thereby protecting against carbon leakage. There may be political obstacles to funding an export rebate, although we should bear in mind that the money could come from auction revenues, which the exporters would themselves have contributed to when buying allowances to meet their compliance obligations. There may also be legal objections to subsidising exported production under the system when an installation outperforms its benchmark. But this feature could be removed by not allowing Reimbursable Emissions to exceed actual emissions at the end of the compliance year. This would come at the cost of not exposing exporters fully to the carbon price signal with respect to emissions intensity, however. Alternatively, the benchmark could be set slightly beyond best practice at the time, but this would come at the cost of weaker carbon leakage protection. Perhaps the most fundamental issue, though, is whether the system would cause market distortions at home by treating ETS installations differently depending on whether they sell their product in the EU or abroad. Take two identical installations making a product in the EU, for instance. Installation A—which sells its product in the EU—would have to buy EUAs to meet its compliance requirements not covered by free allocation. Installation B—which sells its product abroad—would have to do the same but would also receive a rebate as outlined above. We can see that selling a product in the EU would only be as profitable as exporting it under this system if the product could be sold for a premium in the EU (due to the import tax). And the premium would have to be equivalent to the export rebate per tonne of product. That is, EU premium per tonne = CP x [PB – (CLEF x PB x CSCF)] CP – Carbon Price PB – Product Benchmark used in the EU ETS for the product in question (CO2e/t) CLEF – Carbon Leakage Exposure Factor (currently 1 for sectors on the Carbon Leakage List) CSCF – Cross Sectoral Correction Factor applied to entitlements that year (due to there not being sufficient allowances) For this to hold there would have to be very substantial pass-through of the import tax into ETS product prices. Whether world supply curves can be assumed to be so elastic across all the relevant markets in the EU would need to be examined. Alternatively, reimbursements might be 'reverse engineered' to reflect the EU market premium for the product in question due to the import adjustment: Reimbursable Emissions = ET x PTF x [AEI – (CLEF x PB x CSCF)] ET – Export Tonnage PTF – Pass Through Factor (i.e. the percentage of the import tax passed on into the EU price per tonne of product) AEI – Average Emissions Intensity for the product in question in the EU (CO2e/t) CLEF – Carbon Leakage Exposure Factor (currently 1 for sectors on the Carbon Leakage List) PB – Product Benchmark used in the EU ETS for the product in question (CO2e/t) CSCF – Cross Sectoral Correction Factor applied to entitlements that year (due to there not being sufficient allowances) How PTF would be determined, and whether modulating reimbursements according to PTF would be consistent with assessments of carbon leakage risk, would need further consideration (as would the implications of retaliatory tariffs from major economies). Exemption As an alternative to reimbursement, emissions associated with exported production could be exempted from the obligation to surrender EUAs up to benchmark level per tonne not covered by allocation. Exporters could be rewarded with EUAs from a pot under the cap if their compliance emissions were lower than their exemptible emissions due to outperforming the benchmark. Exemptible Emissions = ET x [PB – (CLEF x PB x CSCF)] ET – Export Tonnage PB – Product Benchmark used in the EU ETS for the product in question (CO2e/t) CLEF – Carbon Leakage Exposure Factor (currently 1 for sectors on the Carbon Leakage List) CSCF – Cross Sectoral Correction Factor applied to entitlements that year (due to there not being sufficient allowances) Like the reimbursement system, this would expose exporters fully to the carbon price signal with respect to emissions intensity but reduce their carbon costs. It would also abate (or reverse) the carbon price signal with respect to production decisions, thereby providing carbon leakage protection. The same issues may present themselves in terms of forgoing ETS revenues and subsidising exports, but perhaps less directly by virtue of the adjustment not being administered in money. Similarly, the provision of subsidy could be avoided by not allowing Exemptible Emissions to exceed compliance emissions or by setting a more stringent benchmark. Likewise, the same market distortion issues would need consideration, with the possibility of defining Exemptible Emissions to reflect pass-through of the import tax into ETS product prices. In terms of how exemption differs from reimbursement, it has the disadvantage of requiring the ETS cap to be redefined (due to the exclusion of some territorial emissions) and would potentially cause a greater divergence in the cash flow situation of installations selling in the EU and those exporting. But it has the advantage of not having to provide a reimbursement based on a carbon price that may differ from the one paid to meet compliance. Free allocation Rather than providing an export adjustment, free allocation could be retained for exports (subject to review in relation to international carbon pricing) while phasing it out for other production. Allocations in this instance would be calculated using exported production levels rather than total production levels. Providing dynamic allocation would expose exporters to the carbon price signal with respect to emissions intensity, while reducing their carbon costs and abating (or reversing) the carbon price signal with respect to production (thereby providing carbon leakage protection). This would broadly raise the same issues as an exemption, but would not require a redefinition of the ETS cap. Providing non-dynamic allocation, on the other hand, might help mitigate risks of market distortion, because domestic producers would not be rewarded with free allowances if they were to switch from selling in the EU to exporting. But it would come at the cost of creating windfall profits for contracting exporters and could not really claim to provide carbon leakage protection, insofar as it would not abate the carbon price signal with respect to production decisions. Conclusions A basic CBA for imports is relatively straightforward to design and could theoretically replace free allocation as a means of establishing a level playing field for EU producers selling in the EU. This transition could even be automated through inclusion of the CLEF and CSCF in the calculation of Chargeable Emissions. This would not provide an alternative to free allocation for exporters, however, so an export adjustment would also have to be offered (or free allocation retained for exporters) if the system was to replace the current one. A tandem system of this sort would face myriad political and legal obstacles and have complex implications for the domestic market, creating different conditions for installations selling in the EU and those exporting. Whether the benefits over the current system warrant dealing with the challenges would have to be carefully considered. An import-only adjustment administered as a complement to the free allocation system, could strengthen carbon leakage protection at home and encourage emissions reduction abroad. It might also promote international carbon pricing, whether implemented or just threatened. But if such a scheme is introduced with the ultimate intention of replacing free allocation, it could be a wolf in sheep’s clothing for exporting installations. For further information, please contact [email protected] In a 2017 post we set out some guiding principles for accommodating CCU into the EU ETS, drawing on a report co-authored with André Bardow. Now seems like a good time to revisit the issue. Late last year, in response to an ECJ ruling, the European Commission revised the Monitoring and Reporting Regulation (MRR) to exempt emissions from the ETS that are transferred out of an installation for the purposes of making precipitated calcium carbonate (PCC). And this year the Commission is reviewing the MRR ahead of Phase IV, providing an opportunity to further accommodate CCU practices into the ETS. This has prompted a number of reports with recommendations in this area (e.g. Umweltbundesamt and CE Delft). Building on the principles in our original post, then, let’s consider how best to move forward with the MRR revision and potential revisions to the ETS Directive during Phase IV. 1. Implementing the ECJ ruling One of our immediate priorities should be implementing the aforementioned ECJ ruling in a way that does not create an incentive to move emissions outside the jurisdiction of the carbon price. As amended, the MRR currently provides a full exemption for emissions transferred out of an installation for the purposes of making PCC, despite the fact that PCC can go into a range of applications, some offering permanent storage and others not, and despite the fact that Annex 1 of the ETS Directive has not been revised to ensure that installations involved in transporting and processing these emissions are regulated by the ETS. This outcome reflects a problematic reading of the ECJ ruling, which has it that emissions are unreleased by the court’s reckoning when chemically bound in a stable product, such as PCC. This could open the door to exemptions across the board for CCU practices, even though they have very varied environmental performance (which often depends on very low-carbon electricity) and emissions are often released at the end-of-life stage where they are not subject to the carbon price. The ECJ ruling, however, does not say that all emissions captured for the purposes of making PCC (or, more generally, that are chemically bound in a stable product) are unreleased. It only says that it is wrong to presume that all emissions captured for the purposes of making PCC are released: which is very different. Indeed, the ruling makes clear that leakage en route or at the processing installation would constitute a release. And the ruling does not preclude end-of-life emissions being classed as a release. To protect the integrity of the ETS, therefore, the Commission should interpret ‘release’ in a strict sense to include all stages after capture, limiting exemptions to emissions that are permanently stored (e.g. through mineralisation) and adjusting Annex 1 to ensure that installations involved in transporting and processing such emissions are covered by the ETS. By contrast, the MRR revision should not be used to extend exemptions to CCU fuels and products more generally just because emissions are chemically bound in a stable substance. And the ECJ ruling—which concerns whether captured emissions are released—does not provide a legal basis or implicit methodology for calculating partial exemptions that would in fact derive their justification from counterfactual emissions savings cradle-to-gate in the value chain (cf. Umweltbundesamt). 2. Solving the CCU-fuel double-charging problem A second issue we must address is that the ETS would currently double charge for emissions if a CCU-fuel was made and burnt entirely within the ETS. To avoid this, the Commission could apply a zero-rate emissions factor for CCU-fuels burnt at ETS installations, provided the emissions used to make the fuel were captured and processed within the ETS. This could follow the approach taken with biomass currently and would be consistent with the interpretation of the ECJ ruling advocated above, which is to say that the captured emissions would not be exempted because they would be classed as ‘released’. Installations involved in transporting and processing emissions for use in CCU-fuel would have to be included in the ETS, and CCU-fuel produced within the ETS would need to be certified as such (distinguishing it from imported CCU-fuel). This seems much simpler than providing an exemption at the point of capture, which would require the capturing installation to prove that the emissions were later processed into a CCU-fuel that was burnt within the ETS. 3. Reforming accounting practices The proposed approach (exempting permanently stored emissions and avoiding double charging within the ETS) is consistent with existing ETS principles and does not require any adjustment to ETS or Effort Sharing Regulation (ESR) budgets. No additional EUAs/AEAs would be issued, and no exemptions would be provided in the ETS for counterfactual value-chain savings or savings in ESR sectors. But there are still accounting issues to deal with, because emissions captured in the ETS for CCU-materials and extra-ETS CCU-fuels would be counted in the ETS and at the end-of-life stage in the ESR. Furthermore, there is a systemic accounting problem that needs attention; namely that currently the ETS fails to incentivise negative emissions technologies and practices that deliver compound benefits such as BECCS. One solution would be to move to a gross-net accounting system in the ETS that distinguishes between an installation's EUA obligation and the emissions attributed to it for accounting purposes. Table 1. ETS gross-net accounting Under such a scheme, an installation would have a Gross Emissions value (GE), which would comprise its total emissions, minus any transferred for permanent storage (underground or otherwise) and any transferred under existing MRR waste-gas rules. Total emissions, here, would cover all emissions released at the installation (including leaks of received emissions and emissions from burning biomass and intra-ETS CCU-fuel) as well as any emissions produced in the installation that were transferred. (To be clear, emissions from burning biomass and intra-ETS CCU-fuel would not be zero-rated when calculating GE.) An installation would then derive its Net EUA Obligation (NEUAO) by subtracting its biomass and intra-ETS CCU-fuel emissions from its GE. And it would separately derive its Net Emissions for the Purposes of Accounting (NEPA) by subtracting any additional transfers out of the installation from its GE (e.g. for making CCU-fuel or CCU-materials). This approach would: i) preserve the existing biomass incentives, ii) avoid intra-ETS CCU-fuel double charging, iii) prevent double counting by accounting for emissions where they take place, iv) improve the accounting for biomass emissions in the energy sector (currently done via LULUCF reporting), and v) provide incentives for negative emissions and practices with compound benefits for the first time. On this last point, installations with negative emissions (e.g. those conducting BECCS or DAC) would have to be added to Annex 1 and they would be issued EUAs in accordance with their negative NEUAO. The EUAs could come from a reserve under the existing ETS cap to ensure emissions reductions are additional rather than a form of offsetting. Now, double charging would happen under this system if emissions were captured from an installation for use in an application that did not offer permanent storage and the receiving installation leaked the emissions. But this is the only acceptable approach, because not charging for the leak at the second installation would create perverse incentives. (And the system would still correctly count the emissions once.) 4. Rewarding CCU value-chain savings None of the above is to say that CCU applications that don’t offer permanent storage cannot reduce emissions. It’s just that savings would be counterfactual value-chain savings. That is, a CCU value chain can emit less cradle-to-gate compared to a virgin fossil feedstock value chain. Let’s consider, then, how this sort of emissions avoidance could be incentivised within the ETS, which is currently set up to charge installations for their actual emissions. One option would be to modulate the EUA obligation at the installation capturing the emissions to reflect the estimated cradle-to-gate counterfactual saving (taking into account key factors such as the CCU application and energy mix). Modulating the attribution of emissions to the installation would create complications for accounting between the ETS and ESR, so accounting could be kept separate by distinguishing NEUAO and NEPA as above. Table 2. Modulating EUA obligations The problem with this approach, though, is that it would fundamentally change the nature of the cap by exempting actual emissions based on counterfactual emissions savings. It would also be difficult to calculate the EUA Obligation Rates and burdensome to administer, requiring coordinated reporting between installations along value chains.

A better option might be to issue EUAs under Article 24(a) of the ETS Directive to projects that deliver counterfactual savings (or savings in non-ETS sectors). The EUAs could be sourced from the existing cap (or transferred from AEAs) to preserve the integrity of carbon budgets. Accounting could still be based on the NEPA approach outlined above, with estimation of counterfactual value-chain savings done separately by the project consortium purely as a condition for receiving credits. Nevertheless, developing project mechanisms under Article 24(a) is a big task and project participants would face significant administrative burdens. Given the current scope of the ETS, then, perhaps the best option is to explore other incentives for those CCU practices that do not offer permanent storage and where emissions are potentially released in non-ETS sectors. There are lots of options. As well as funding R&I and stimulating investment, we could look at quotas for alternative feedstocks in products, for instance, or price interventions to overcome barriers to the uptake of alternative feedstocks, such as CfDs. And in the long run we should consider incorporating end-of-life emissions in CCU value chains (e.g. from incineration) into the ETS so we can provide a simple exemption at the point of capture without undermining the actuality of the cap. For further information, please contact [email protected] According to the latest status update from the European Commission, the Phase III NER is currently 70% full, with 336 million allowances still remaining out of an original 480 million. Using a simple model of how the NER works, we estimate that ~295 million allowances will be left by the end of Phase III. Explanation:

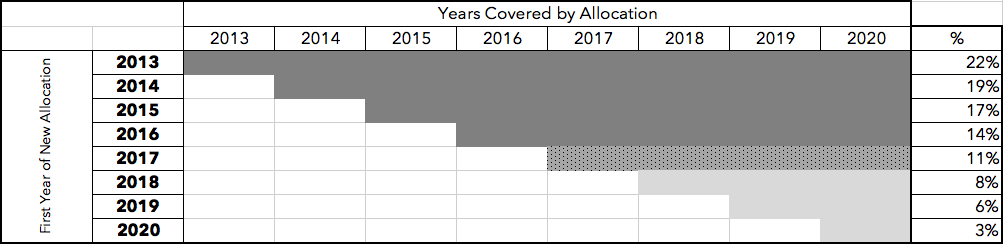

For further information, please contact [email protected] A summary of key dates relating to the implementation of the ETS Phase IV deal, and further ETS reform.

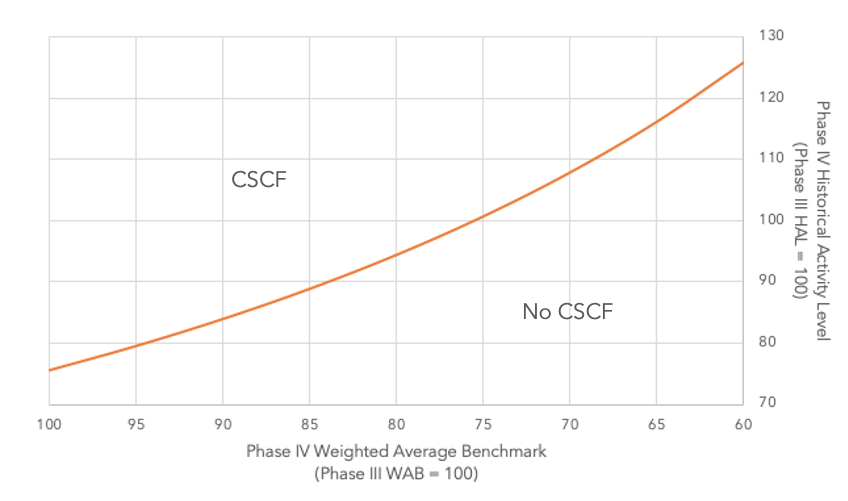

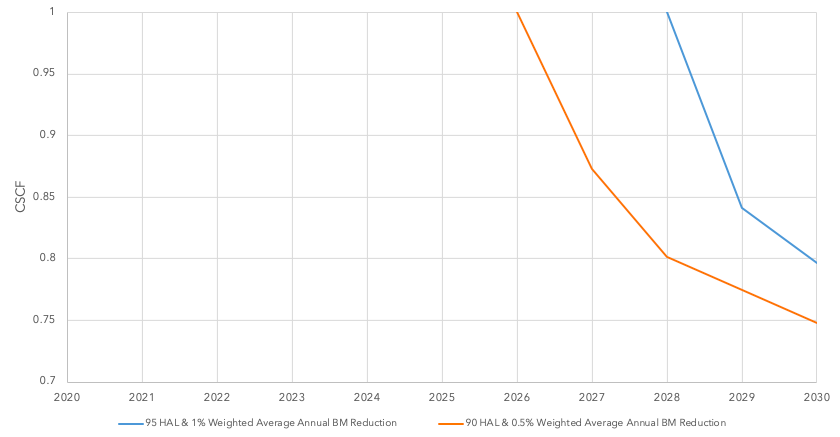

This graph shows under what circumstances a CSCF will be triggered in Phase IV. A data point above the curve represents an activity level and benchmark scenario that would trigger a CSCF; a data point below the curve represents an activity level and benchmark scenario that would not trigger a CSCF. Explanation

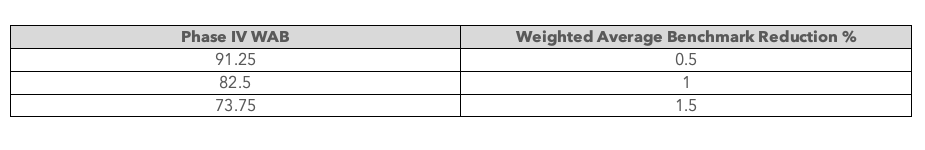

Benchmark reduction rates If we assume no change in the proportion of activity associated with each benchmark, Phase IV WAB values would correspond as follows to the annual benchmark reduction rates used by the European Commission to revise benchmarks: Of course, the weighted average benchmark reduction percentage is unlikely to be uniform across all benchmarks (or equivalent to the simple average) and it may be influenced by a change in the proportion of activity associated with each benchmark. Observations If we assume production will be about 10% lower in the Phase IV baseline period (i.e. Phase IV HAL = 90), we would expect to avoid a CSCF if the weighted average benchmark reduction exceeded 1%. As we deviate from this scenario with a higher level of activity or lower benchmark reduction, we would expect to trigger a CSCF of increasing severity. Two such scenarios are shown below: one assuming 5% lower production in the Phase IV baseline period, coupled with a 1% weighted average benchmark reduction; and the other assuming 10% lower production in the Phase IV baseline period, coupled with a 0.5% weighted average benchmark reduction. It is assumed in the graph that there is no change in the proportion of activity associated with the benchmarks, and that the number of free allowances available in a given year is 40.9% of the relevant annual cap, plus whatever remains of the CSCF buffer pool of allowances, which is 3% of the total cap (where the total cap is defined as above, assuming a 2.2% LRF throughout and inclusion of the UK).

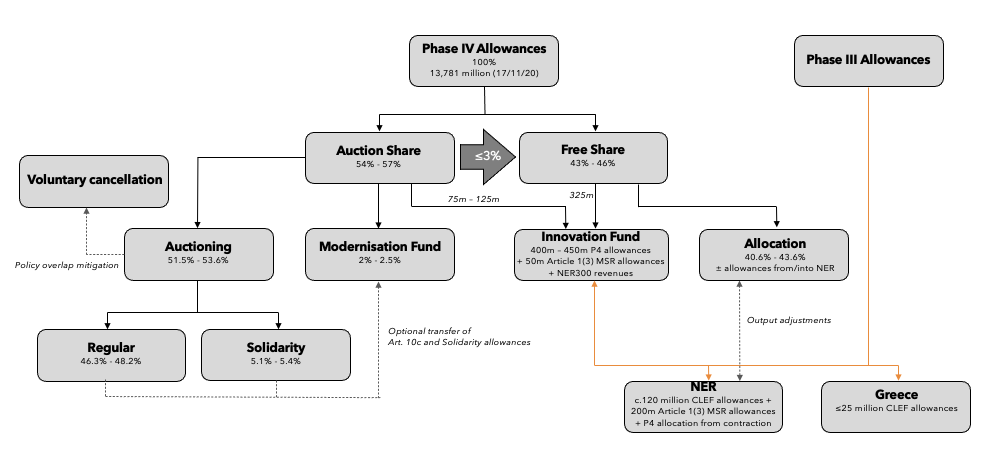

The trajectory of the CSCFs reflects the fact that the 3% buffer is concealing a growing shortfall between entitlements and the annual cap. In the year the buffer runs out, this large shortfall is partially revealed. In the following year, the shortfall is fully revealed (including an additional year of the LRF). And from this point on the CSCF tracks the LRF. Uncertainties It is unclear where activity levels and benchmarks will come out at this stage. The Commission will gather data ahead of each half of the phase, so we will have a much better sense of the CSCF outlook in 2020, but the ultimate values will only be known around 2025. It is assumed in the modelling that the LRF is 2.2% throughout Phase IV, but this could be upgraded, which would increase the risk of a CSCF. Depending on how the Commission interprets the provisions in the ETS Directive, it is also possible that a CSCF might follow a different trajectory to the ones graphed above. For further information please contact [email protected] [Revised on 17/11/20 to align the total cap with the Commission Decision on the Union-wide quantity of allowances to be issued under the EU Emissions Trading System for 2021] Based on our analysis of the provisionally agreed Phase IV ETS text, the Phase IV cap breaks down as follows: Assumptions and notes:

Auction Share Key Points

Free Share Key Points

Funds Key Points

For further information please contact [email protected] |

Damien GreenManaging Director Archives

February 2023

Categories |