|

It's evident from the provisionally agreed Phase IV ETS text that incorporating CCU into the ETS is going to be left to Phase V. Recital 10 recognises CCU, but there is no exemption from the obligation to surrender allowances in Article 12 for installations capturing emissions for CCU purposes, nor is there a zero rating for CCU-fuels burned by ETS installations. Indeed, the Commission’s statement on the negotiated text says the following on CCU:

The Commission takes note of the European Parliament’s proposal to exempt emissions verified as captured and used ensuring a permanent bound from surrender obligations under the EU ETS. Such technologies are currently insufficiently mature for a decision on their future regulatory treatment. In view of the technological potential of CO2 Carbon Capture and Use (CCU) technologies, the Commission undertakes to consider their regulatory treatment in the course of the next trading period, with a view to considering whether any changes to the regulatory treatment are appropriate by the time of any future review of the Directive. In this regard, the Commission will give due consideration to the potential of such technologies to contribute to substantial emissions reductions while not compromising the environmental integrity of the EU ETS. CCU is indeed relatively immature, and the EU must take an evidence-based approach to integrating CCU technologies into the policy framework. Nevertheless, we can consider some general principles for accommodating CCU in ETS Phase V:

0 Comments

MEPs have called for stricter carbon budgets in the 2020s, and extending annual budgeting up to 2050

MEPs in the Environment Committee (ENVI) voted to adopt a position on Tuesday on the Commission’s proposed Effort Sharing Regulation (ESR), which when passed into law will set annual non-ETS carbon budgets for Member States from 2021-30, replacing the current Effort Sharing Decision (ESD). The MEPs’ Report (which has yet to be published) comprises the following proposed amendments to the Commission’s draft law (which can be found here): Compromise Amendments A, B, C, D, E ENVI Amendments 3, 28, 30, 31, 64, 94, 113, 114, 194, 249 TRAN Amendments 5, 6, 8, 25 26 ITRE Amendments 1, 2, 6, 12 AGRI Amendments 2, 5, 10 The amendments would retain the Commission’s proposed 2030 carbon budgets for Member States, with a linear reduction from 2021, but would start with lower budgets in 2021, thereby reducing the overall carbon budget for the period. The MEPs have also proposed including (non-ETS) emissions from aviation and shipping within the scheme, and extending budgeting from 2030 to 2050, with a linear reduction terminating in budgets that are at least 80% below each Member State’s 2005 emissions. In terms of flexibilities, the amendments would allow more borrowing from future years’ budgets, and more trading of budgets between Member States, but introduce new restrictions on banking budgets. The MEPs also propose restricting the extent to which Member States can count net removals from LULUCF within their emissions accounting, allowing for a total of 190 million tonnes, rather than 280 million tonnes. The amendments would retain the Commission’s proposal to allow Member States to use up to 100 million ETS allowances towards compliance, but would require the cancelled permits to be counted as still in circulation for the purposes of calculating the ETS market surplus. This would essentially lower the Market Stability Reserve threshold by up to 100 million in ETS Phase IV. The MEPs have also proposed a new flexibility mechanism—the Early Action Reserve—that would allow low-GDP-per-capita Member States that have overachieved their ESD targets to expand their ESR budgets by up to 70 million tonnes between 2026-30 under certain conditions. This amounts to allowing limited banking of ESD budgets into the ESR period. The amendments leave open the possibility of incorporating Paris flexibility mechanisms and domestic offsetting schemes under Article 24a of the ETS Directive into the ESR. They would also require more regular checks on progress (every two years), greater transparency, and an earlier review of ambition in 2018. Parliament is expected to vote on the Report (and any other amendments tabled ahead of plenary) in June, thereby adopting a position. Member State governments, meanwhile, aim to reach a position at the Environment Council on 19th June, potentially enabling the file to move to trilogue. Contact: [email protected] Links: Briefing Minimising the risk of a CSCF in ETS Phase IV has preoccupied policymakers, but the choice to apply the LRF to certain allocations has slipped under the radar unquestioned.

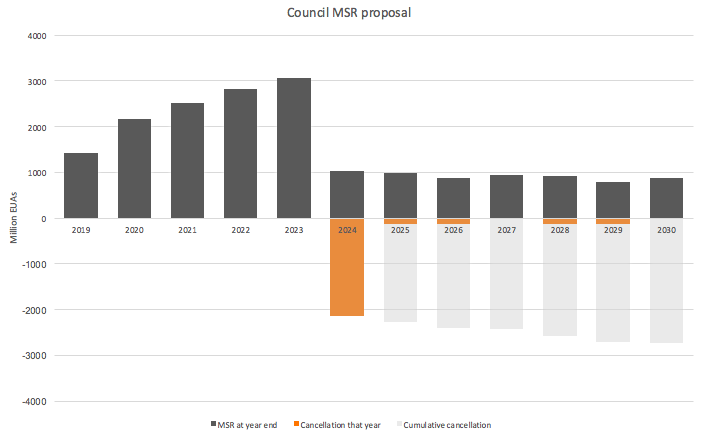

The Linear Reduction Factor (LRF) is not just used to calculate the number of ETS allowances issued each year. It's also used to reduce free allocation to certain installations in much the same way as the more notorious Cross-Sectoral Correction Factor (CSCF). This has not received the attention it deserves and could have significant implications in Phase IV for new and expanding installations. According to Article 10a (paragraphs 4 and 7) of the EU ETS Directive (and the related Benchmarking Decision), the LRF must be applied when calculating allocation to certain installations that generate electricity, as well as new capacity entering the EU ETS. This is done cumulatively, cutting allocation by an additional 1.74% every year during Phase III. Other installations receiving free allocation, meanwhile, have the CSCF applied instead (if there is one). In Phase III, installations subject to the LRF will lose a smaller proportion of their allocation than those exposed to the CSCF: 12.2% in 2020, for example, rather than 17.5% (based on the original CSCF values). But in Phase IV the situation may well be reversed, as the LRF increases and measures to reduce the risk of a CSCF (such as auction share flexibility) are introduced. If the LRF haircut were reset to 0% at the beginning of Phase IV and then raised annually by 2.2 percentage points, installations exposed to the LRF would lose 19.8% of their entitlement in 2030 and almost 10% on average during the phase. This exceeds most expectations for a Phase IV CSCF. If, on the other hand, the LRF haircut was not reset but continued from where it left off in Phase III, it would cut relevant entitlements by 14.4% in 2021 and 34.2% in 2030, averaging 24.3% across the phase. This far exceeds forecasts for the CSCF. If the LRF continues to be applied to new entrants' and expanding incumbents' allocations in Phase IV, then, it could mean that new production receives significantly fewer allowances than incumbent production (until accommodated in the next NIMs round), even if it is indistinguishable in every respect and the New Entrants' Reserve is well stocked. We might question why the LRF is being applied at all. The CSCF is triggered by a shortfall in allowances that year, but applying the LRF is a choice with no direct connection to constraint in supply. If policymakers are determined to eliminate the CSCF, why are they choosing to apply the LRF? Perhaps the argument will be made that installations should be improving their emissions intensity in line with the ETS cap so should receive fewer allowances every year. But the new benchmark proposals for Phase IV already factor in annual improvements in a more nuanced way. And this wouldn't justify applying the LRF selectively to new production, creating an uneven playing field between installations. Or perhaps the aim is to level the playing field with incumbent installations subject to the CSCF. But in this case why not apply the CSCF to new production rather than a different haircut? For many installations, the LRF could be the threat in Phase IV, not the CSCF. This could be changed by policymakers at the stroke of a pen, without the need for complex mechanisms, and deserves greater attention during trilogue. If, the ETS Directive retains provisions in this area, it will be important to define in implementing legislation how the LRF will be baselined and whether it will apply to expanding installations' as well as new entrants' allocations. Contact: [email protected] The Council's MSR proposals could cancel 2-3 billion ETS allowances in Phase IV (2021-30) The Council has proposed doubling the withdrawal rate of the MSR for 5 years, and cancelling MSR allowances from 2024 when the number exceeds the amount auctioned the previous year. Parliament by comparison has proposed doubling the MSR rate for ~4 years, and cancelling 800 million allowances ahead of Phase IV. Our provisional modelling suggests that the Council position would cancel far more allowances, perhaps 2-3 billion, with the vast majority being cancelled in 2024. We estimate, for instance, that 2.7 billion allowances would be cancelled during Phase IV, with 2.1 billion being cancelled in 2024, making the following assumptions:

If emissions run further below the cap, we would expect greater cancellation. Bearing in mind this sensitivity, we estimate that cancellation would fall in the range of 2-3 billion, with around 2 billion cancelled in 2024.

Contact: [email protected] On 28th February the EU Council adopted a General Approach on ETS reform that will form the basis of its negotiating position in trilogue.

It’s structured on the Commission's 2015 proposal, but with significant strengthening of the Market Stability Reserve (MSR), more accurate benchmark reductions, and 2% flexibility in the auction share. Surprisingly, the position is more ambitious than Parliament’s adopted on 15th February, and provides industry with less protection from a correction factor (i.e. it carries a higher risk of a haircut in free allocation). We now have a good sense of each institution’s position, and it is evident that there is a great deal of convergence. We can predict with some confidence, then, that the final ETS reform package will look roughly as follows:

How the institutions compromise on MSR cancellation and auction share flexibility will be the most critical areas to watch during trilogue, in terms of the impact on carbon prices and the risk of a Phase IV correction factor. Other areas to watch (where there is less agreement) include, how funds are stocked (which has an impact on the correction factor), and whether there is central compensation for indirect carbon costs (as proposed by Parliament but not Council). Contact: [email protected] Notes: The main aspects of the Council’s position are as follows:

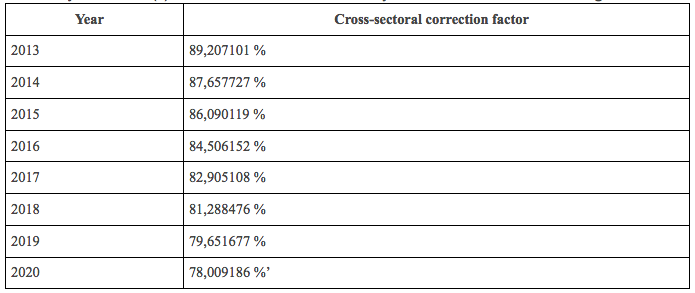

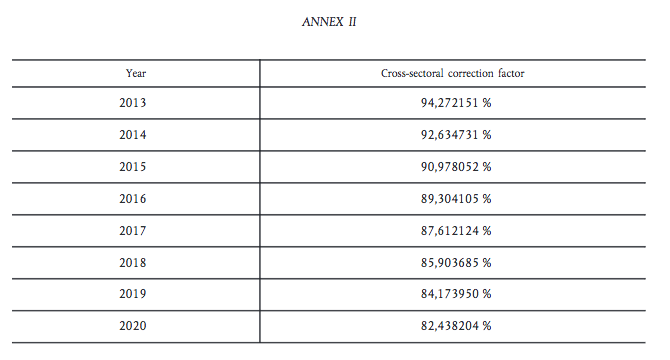

If the 'Duncan mechanism' doesn't survive trilogue it could mean another CSCF in ETS Phase IV

This week the European Parliament adopted a position on EU ETS Phase IV (2021-30) that will form the basis of its negotiations with the Council and Commission in trilogue. One distinctive aspect of the position is the so-called 'Duncan mechanism', named after the file's rapporteur--Ian Duncan MEP. This would allow up to 5% of the total number of allowances to be transferred from the auction share to the free share during Phase IV if the number owed to installations would otherwise exceed the number available. Due to the Duncan mechanism (and factoring in differences in how funds would be stocked), Parliament's proposal would make ~10% more free allowances available compared to the Commission's proposal, providing additional protection from a CSCF of ~9%. The mechanism is especially important now that other proposals that would have reduced the risk of a cross-sectoral correction factor (CSCF) have fallen by the wayside, such as tiering the carbon leakage list, and introducing carbon border adjustments for the cement sector. Based on the emerging position in the EU Council, however, it looks like the mechanism may not survive the legislative process—at least not without significant dilution. While Member States regularly pay lip service to wanting to avoid a CSCF, the Duncan mechanism is a hard sell in the Council because governments value auction revenues, and certain Member States use a share of their auction volumes for free allocation to the power sector under Article 10c. At December’s Environment Council, only a small minority of Member States expressed support for the Duncan mechanism (or expanding the size of the free share): most notably, Germany, Belgium, Italy, and Greece. Meanwhile, there was a broad group (comprising Member States that would often occupy opposing poles in the debate), expressing a preference for the Commission’s proposed auction share. While all attention was focused on Parliament last week, Coreper was meeting behind closed doors, and on Friday a draft text was published with the aim of agreeing a general Council position when ministers meet on 28th February. Looking through the draft text, it’s evident that the Council’s emerging position is based closely on the Commission’s 2015 proposal, but with some important changes: namely, 1) doubling the withdrawal rate of the MSR (as proposed by Parliament), 2) reducing benchmarks more accurately (in a very similar manner to that advocated by Parliament), and 3) introducing 1% flexibility in the auction share. Doubling the MSR withdrawal rate is contentious with Eastern European Member States, and the proposed 1% flexibility is a thorny issue with many, with the number still bracketed in the text. Nevertheless, we might expect the Council’s eventual adopted position (whether it's reached in February or June)—and indeed the final package to emerge from trilogue—to look quite a lot like this. In terms of what this would mean for a CSCF in Phase IV, we can refer to analysts' existing models of the Commission's proposal (given the identical provisions relating to the number and distribution of allowances), and just adjust for the new aspects of this hypothetical final package. In terms of these adjustments, the MSR doubling proposal would not affect the CSCF estimates, because it reduces the historic market surplus via the auction share. (Although it would increase the value of any shortfall in allocation.) Having 1% flexibility in the auction share, on the other hand, would reduce the risk of a CSCF compared to the Commission's proposal, but would only provide protection from a ~2.5% haircut--significantly less than Parliament's proposal. Meanwhile, more accurate benchmark reductions (within a corridor of 0.3% - 1.5% p.a. from 2008) might be expected to result in a lower average benchmark reduction than the Commission's flat-rate proposal, which would increase the risk of a CSCF. Making these adjustments, and assuming some modest growth, we might expect the package to trigger a CSCF if the weighted average benchmark reduction comes out below ~0.9% per annum, reaching significant levels as the reduction approaches 0.5%. For further information, please contact [email protected] UPDATED: 07/02/17 DISCLAIMER: The below represents the author's interpretation of the implications of the new CSCF, and should not be taken for the official position of the Commission. Following a ruling from the European Court of Justice (ECJ), the European Commission has revised the Cross-Sectoral Correction Factor (CSCF) values for ETS Phase III (2013-20). The new values will only be applied from March 2017 when agreeing free allocation adjustments for sites that have undergone a significant capacity reduction. When applied they will reduce free allocation to an installation by an additional 4-5 percentage points compared to the old CSCF values. If installations require no adjustment to their free allocation (because they have not experienced a significant capacity or activity level change) their allocation up to 2020 will remain as defined in existing National Implementation Measures. If installations require an adjustment in free allocation due to a capacity extension or change in activity level they will also be unaffected by the new values. With capacity extensions, the additional allowances come from the New Entrants’ Reserve (NER) rather than the general pool of free allowances, and the NER is not subject to the CSCF. And with activity level changes, Article 23 of the Benchmarking Decision is clear that an adjustment is made without a recalculation that would involve the re-application of the CSCF. I understand that the Commission is updating its Guidance Note on free allocation adjustments to make clear that activity level changes are not affected. The note currently proposes a methodology for recalculating allocation in the instance of an activity level change that uses the CSCF, but this does not have the same legal standing as the Benchmarking Decision. In 2013, 32 installations out of 11,000 had adjustments made to their allocation as a result of a capacity reduction. Assuming a similar proportion (~0.3%) require adjustments each year from 2017, we may see 1-1.5% of installations end up on the stricter CSCF by the end of Phase III. The Commission’s interpretation of the ECJ ruling is more generous to industry than analysts had predicted, only applying the higher CSCF values from 2017 (rather than retrospectively) and then only when modifications are made due to capacity reductions. The new values: The old values: Notes:

Links: ECJ Ruling CSCF Decision FAQ Benchmarking Decision Free Allocation Guidance—To Be Updated 2017 NER Status Report 2014 Activity and Capacity Changes Report Contact: [email protected] |

Damien GreenManaging Director Archives

February 2023

Categories |