|

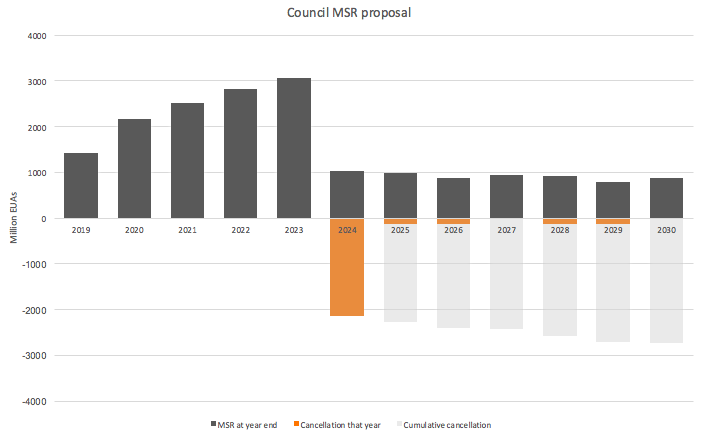

The Council's MSR proposals could cancel 2-3 billion ETS allowances in Phase IV (2021-30) The Council has proposed doubling the withdrawal rate of the MSR for 5 years, and cancelling MSR allowances from 2024 when the number exceeds the amount auctioned the previous year. Parliament by comparison has proposed doubling the MSR rate for ~4 years, and cancelling 800 million allowances ahead of Phase IV. Our provisional modelling suggests that the Council position would cancel far more allowances, perhaps 2-3 billion, with the vast majority being cancelled in 2024. We estimate, for instance, that 2.7 billion allowances would be cancelled during Phase IV, with 2.1 billion being cancelled in 2024, making the following assumptions:

If emissions run further below the cap, we would expect greater cancellation. Bearing in mind this sensitivity, we estimate that cancellation would fall in the range of 2-3 billion, with around 2 billion cancelled in 2024.

Contact: [email protected]

1 Comment

On 28th February the EU Council adopted a General Approach on ETS reform that will form the basis of its negotiating position in trilogue.

It’s structured on the Commission's 2015 proposal, but with significant strengthening of the Market Stability Reserve (MSR), more accurate benchmark reductions, and 2% flexibility in the auction share. Surprisingly, the position is more ambitious than Parliament’s adopted on 15th February, and provides industry with less protection from a correction factor (i.e. it carries a higher risk of a haircut in free allocation). We now have a good sense of each institution’s position, and it is evident that there is a great deal of convergence. We can predict with some confidence, then, that the final ETS reform package will look roughly as follows:

How the institutions compromise on MSR cancellation and auction share flexibility will be the most critical areas to watch during trilogue, in terms of the impact on carbon prices and the risk of a Phase IV correction factor. Other areas to watch (where there is less agreement) include, how funds are stocked (which has an impact on the correction factor), and whether there is central compensation for indirect carbon costs (as proposed by Parliament but not Council). Contact: [email protected] Notes: The main aspects of the Council’s position are as follows:

|

Damien GreenManaging Director Archives

February 2023

Categories |