|

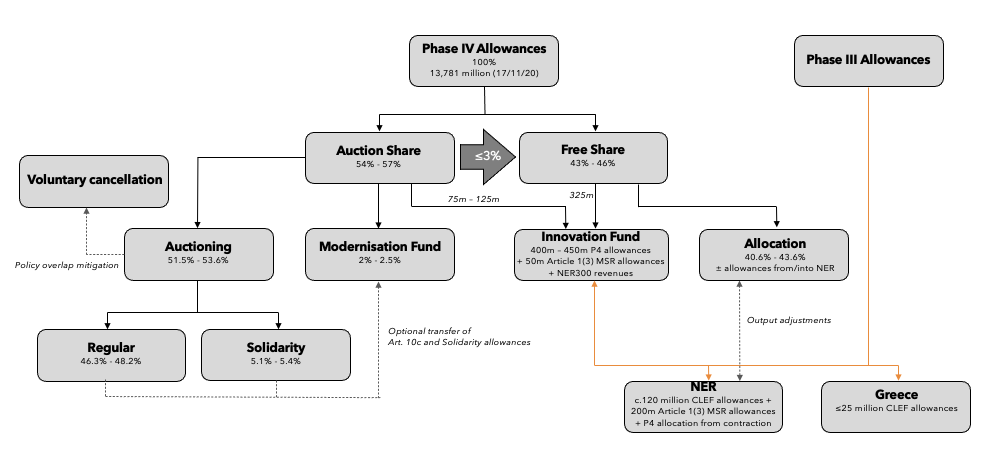

[Revised on 17/11/20 to align the total cap with the Commission Decision on the Union-wide quantity of allowances to be issued under the EU Emissions Trading System for 2021] Based on our analysis of the provisionally agreed Phase IV ETS text, the Phase IV cap breaks down as follows: Assumptions and notes:

Auction Share Key Points

Free Share Key Points

Funds Key Points

For further information please contact [email protected]

0 Comments

It's evident from the provisionally agreed Phase IV ETS text that incorporating CCU into the ETS is going to be left to Phase V. Recital 10 recognises CCU, but there is no exemption from the obligation to surrender allowances in Article 12 for installations capturing emissions for CCU purposes, nor is there a zero rating for CCU-fuels burned by ETS installations. Indeed, the Commission’s statement on the negotiated text says the following on CCU:

The Commission takes note of the European Parliament’s proposal to exempt emissions verified as captured and used ensuring a permanent bound from surrender obligations under the EU ETS. Such technologies are currently insufficiently mature for a decision on their future regulatory treatment. In view of the technological potential of CO2 Carbon Capture and Use (CCU) technologies, the Commission undertakes to consider their regulatory treatment in the course of the next trading period, with a view to considering whether any changes to the regulatory treatment are appropriate by the time of any future review of the Directive. In this regard, the Commission will give due consideration to the potential of such technologies to contribute to substantial emissions reductions while not compromising the environmental integrity of the EU ETS. CCU is indeed relatively immature, and the EU must take an evidence-based approach to integrating CCU technologies into the policy framework. Nevertheless, we can consider some general principles for accommodating CCU in ETS Phase V:

|

Damien GreenManaging Director Archives

February 2023

Categories |